Table of Content

CapitalCore Review – CapitalCore.Com Is Absolutely a Scam

Table of Content

A seemingly professional website advertises CapitalCore as an award-winning, regulated and licensed broker. This company is supposedly able to guarantee total safety and security of funds. All this is false. Founded in 2021, in SVG, this broker is yet not regulated, and offers some questionable trading conditions. It is in its totality an untrustworthy, offshore firm.

| Owning company | CapitalCore LLC |

| Leverage | 1:1000 |

| Regulation | Not regulated |

| Broker Site | capitalcore.com |

| Headquarters | SVG |

| Minimum Deposit | $1 |

| Review Rating | 1/5 |

| Broker Type | Forex |

| Platforms | MT5 |

| Spread | 0.6 pips |

| Demo account | Available |

| Withdrawal fees | Yes |

| Trading instruments | Indices, metals, currency pairs |

| Trading platforms | MT5 |

Claiming to be regulated, CapitalCore would have to appear in some regulator’s register. Searching through databases of FCA, CONSOB, AMF, ASIC, BaFin and others, has given us no result. Broker that just claims to be regulated, without actually providing any proof of regulation or possessing a license, is absolutely not to be trusted.

Are Your Investments Safe With CapitalCore Broker?

Brokers offering financial services would have to respect the given rules by major financial authorities like ESMA and MiFID. These rules especially refer to the protection of investors in terms of obligatory transparency considering the transactions. Offshore brokers under no radar of a jurisdictional regulator keep their anonymity and do not respect these standards.

To be regulated, brokers have to fulfill certain criteria set by jurisdictional regulators. These standards ensure the broker can operate long-term and actually provide the services they offer. Checking the databases of major regulators has provided no result for CapitalCore.

Being unregulated, CapitalCore cannot guarantee the safety of clients’ funds. Licensed brokers keep clients’ funds in segregated bank accounts. Transactions are encrypted and protected, as is clients’ info. Scammers remain anonymous, operating overseas, with the sole goal of robbing clients and slipping away unpunished. Therefore, your funds are not safe with CapitalCore.

What Trading Platform Options Exist?

It seems that CapitalCore does support MetaTrader 5, a most used and recommended trading platform in the industry today. This would have been an admirable trading circumstance about CapitalCore if only this was a regulated broker. Download links were provided for all major platforms and operating systems, including the web version.

MT5, along with its predecessor MT4 have been known as the most reliable and fastest trading softwares. Developed by MetaQuotes, these platforms possess various built-in trading options. Had CapitalCore been a trusted and reliable broker, trading on MT5 there would be an ultimate trading experience.

What Account Types Does CapitalCore Offer?

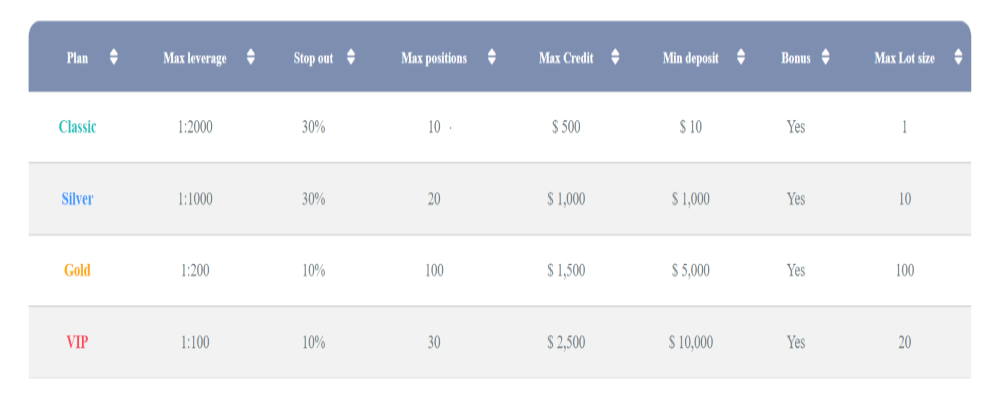

There are 4 account types available at CapitalCore. Each brings different specifications and conditions. Potential customers can choose between the following options:

- Classic account (max leverage of 1:2000, stop out 30%, max positions 10, max credit $500, min deposit $10, bonus included)

- Silver account (max leverage of 1:1000, stop out at 30%, max positions 20, max credit $1000, min deposit $1000, bonus included)

- Gold account (max leverage 1:200, stop out 10%, max positions 30, max credit %1500, min deposit $5000, bonus included)

- VIP account (max leverage 1:100, stop out 10%, max positions 30, max credit $2500, min deposit $10000, bonus included)

It is very unlikely of a regulated broker to offer such insane leverage. This serves as yet another proof of CapitalCore being unregulated. Regulated brokers would not ask for such high initial deposits either.

CapitalCore Trading Instruments Overview

Traders at CapitalCore are given the opportunity to trade various instruments divided into several bigger classificatory groups. Although seemingly offering a big scale of instruments, CapitalCore is still missing some better trading conditions. Regulated brokers bring a bigger number of instruments and spreads from as low as 0.1 pips. Trading instruments available at CapitalCore are grouped as shown below:

- Forex Pairs (AUDCAD, AUDCHF, CADCHF, EURGBP, EURUSD, GBPJPY, NZDCAD)

- Metals (Gold, GoldEUR, Palladium, Platinum, Silver, SilverEUR)

- Futures Indices CDFs (US500, US30, ND100, DAX40, JAP225, UK100)

- Cryptocurrency CFDs (BTCUSD, ETHUSD, BCHUSD, XRPUSD, LTCUSD)

CapitalCore Deposit/Withdrawal Methods

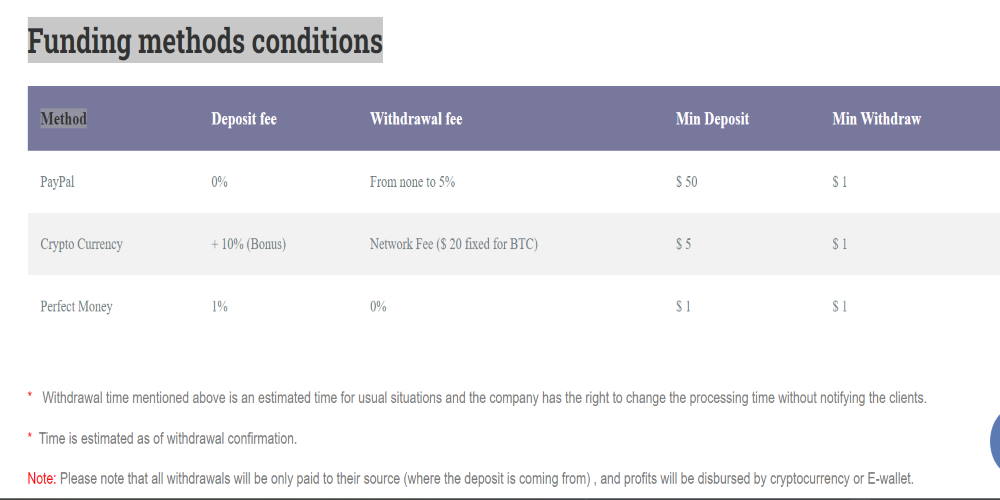

Accounts are funded through various methods like credit/debit cards, crypto, E-wallet, but it seems that the most preferred way at CapitalCore is crypto. Minimal deposit made can be as low as $1. However, the fees given are varying and not entirely in investors’ favor. For example, while the deposit fee for PayPal is 0%, it could go up to 5% for withdrawals with this method.

There are withdrawal fees charged for other withdrawals, like in the case of crypto. CapitalCore also exclaims to keep the right of changing processing time of the withdrawals without notifying the clients.

Some bonuses are included when opening and funding accounts. CapitalCore allegedly gives all clients a bonus of 40% on each deposit.

How Do I Obtain a Refund if CapitalCore Defrauded Me?

If you happen to be a victim of a fraudulent scheme, the best advice to give is to refer to entities like government financial authorities. These institutions are able to take legal action and help you retrieve funds. Sticking to these legal entities that you can trust is the key step.

There are supposed recovery agents that you should not put your trust in. They are just another piece in the big scamming scheme. Their pricey services will not actually assist you in charging back stolen funds, they will only deceive and rob you, too.

CapitalCore Summary

- Not regulated, not licensed

- Overly high leverage

- Withdrawal fees apply

- Bonuses come with conditions

- Crypto depositing urged

FAQs About CapitalCore Broker

Is CapitalCore a Regulated Broker?

No, CapitalCore is an unregulated and unlicensed broker.

What Is the Minimum Deposit for CapitalCore Broker?

Minimum amount accepted is $1. For opening a cheapest account the initial deposit needed is $10.

How Long Do CapitalCore Withdrawals Take?

CapitalCore guarantees alleged fast withdrawals, but also keeps the right to change withdrawal processing time without notifying the customer.