Table of Content

EuropeFX Review – Learn More About EuropeFX broker

Table of Content

EuropeFX broker operated on the market since 2013. They are owned by Maniflex Ltd based in Cyprus. For trading in the EEA zone, companies should have a designated license for trading. Especially for the UK after Brexit. Even though EuropeFX broker had a trusted trading platform and long life in this business, not everything is bright and shiny.

Why this broker backed out of business in 2021 and what other traders think of this broker, read in this unbiased EuropeFX review.

Additionally, we strongly advise you to avoid the fraudulent brokers Tradiso and Novatech fx.

| Leverage | Up to 1:200 |

| Regulation | No regulations |

| Headquarters | Cyprus |

| Minimum Deposit | $200 |

| Review Rating | 3.0 on Trustpilot |

| Broker Type | Offshore non-licensed broker |

| Platforms | EuroTrader / MT4 |

| Spread | From 0.1 pips |

Is EuropeFX a Reliable Broker? Security and Regulation

Not only that they are not reliable, but also due to their actions they lost their license. EuropeFX scam broker was issued a license by CySEC in 2014. However, due to rules violations in 2021, CySEC has withdrawn the EuropeFX license.

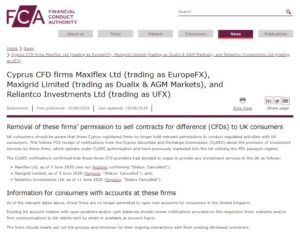

Not only that this institution has actions against this broker, but also Tier 1 regulators. As a matter of fact, FCA and ASIC, one of the most trusted regulators have as well issued a warning against this broker. With this in mind, you can understand that not all licensed brokers are good as well.

FCA Warning:

ASIC Warning:

Trust with a broker is built over time. Primarily through the security that the broker provides. Secondly through transparency and most importantly through compliance with withdrawal policies. If the EuropeFX scam broker complied with any of those, they wouldn’t have more than 30% 1-star reviews on Trustpilot.

Trading Software Overview

EuropeFX investment scam lasted long enough. But traders couldn’t see all the flaws of this broker. For instance, this broker did offer an industry-standard Meta Trader 4 (MT4). However, that is not a sign of a trusted company. As it’s proven through many EuropeFX broker reviews.

MT4 as a platform provides everything that a trader needs to be a successful trader. From advanced charting options, indicators, and many more. Besides, it’s available for any mobile device. Which makes it even more functional and preferable among traders.

On the other hand, this broker had an additional web-based platform named EuroTrader. It’s not even worth comparing with the Meta Trader. It lacks some of the main functionalities and advanced features. Therefore, we suggest you stick to the MT4. Especially through the trading company with Tier 1 licenses. Those are from FCA, BaFin, or ASIC.

EuropeFX Account Types

As for the account types, it all looks like that was just a luring scheme. The idea of their account types was to make clients increase their investments. With shady benefits, traders were investing all their savings. According to EuropeFX reviews they never settled for withdrawal or refund of those funds.

Anyway, those accounts were:

- Bronze

- Silver

- Gold

- Platinum

- Premium

Only from a Platinum account that requires $50.000, traders can get lower trading costs. All up until then are shady benefits like copy trading, SMS trading signals, etc. All this is often manipulated so that traders believe what brokers want them to believe.

Trading Instruments You Can Trade

EuropeFX broker scam was operating through 190 assets. Mostly in Forex, but also in some CFD options like:

- Commodities – Gold, Crude oil

- Cryptos – BTC, LTC

- Stocks – Apple, Microsoft, AMD

- Indices – S&P 500, FTSE 100

Compared to some other Tier 1 regulated brokers, this is a quite poor offer. With their fairly competitive spreads, it might look like it’s a good choice. However, with spreads starting from 0.1 pips, you can always expect higher commissions. For instance, with EuropeFX that commission goes as high as $30 per traded lot.

That is a simple marketing trick, but in the end, it costs you the same. At the end with this broker, it costs you everything you have.

Even though they had leverage according to ESMA rules, that is still too high for some assets. Instead, you should opt for some other brokers that have stricter regulations. That way you can stay protected and profitable. Not to mention negative balance protection that keeps traders safe from getting into debt. Which the EuropeFX broker didn’t provide.

Options for Deposit and Withdrawal

Besides some reliable options like card transfers, this broker offered some uncommon options. Third-party e-payment processors were some of the options. Such are Skrill, Trustpay, iDeal, and more. What we always advise traders is to use cards with shady brokers. In that case, they can get a chargeback if something goes wrong.

As for withdrawals traders can use the same method that was used for a deposit. Those withdrawals take 1-3 business days and cost $20 for every request. However, some traders have had shocking experiences with this broker. Not only that they required some unreasonable fees, but also they were preventing traders from getting withdrawals. That’s one of the main reasons why they lost their license.

Anyone would expect this broker to terminate all their services upon warnings from regulators. On the contrary, they continued doing the same thing. Therefore be extremely careful and do your due diligence before investing any money!

How Do I Get My Money Back If EuropeFX Scams Me?

With any Tier 1 regulator brokers is the member of the compensation funds commission. With CySEC traders are entitled to compensation of up to 20.000 EUR. However, some traders have tried recovering their lost funds and still, there are no results.

However, our fund recovery team is specialized in those actions. You can start your fund recovery process already today. With a chargeback as a solution, you might get funds back sooner than you think. Don’t waste any more time and contact us now!

EuropeFX Summary

- Numerous warnings and ongoing investigations against the broker.

- Lost their license due to fraudulent activities.

- Shady alternative trading platform.

- Claim to voluntarily renounce their license, but it’s actually withdrawn.

- Clients still can’t recover their lost money.

FAQs About EuropeFX Broker

What is EuropeFX Minimum Deposit?

The minimum requirement is quite standardized at $200. But the loss of their license should prevent you from investing even that.

Does EuropeFX Offer a Demo Account?

To sum it up, yes. This is quite surprising, considering their goal to extort as much as possible from traders.

What Types of Accounts Does EuropeFX Offer?

There are 5 different account types. Starting with bronze, silver, gold, platinum, and premium. However, none of these brought any spectacular benefits to traders.