Table of Content

GCB London Review – Don’t This Broker Scam Your Money

Table of Content

Here, in the GCB London Review, we intend to expose an outrageous scammer that had the audacity to lie about operating in the United Kingdom.

Upon noticing the extremely high leverage that this broker offers, we immediately knew something was fishy and thus decided to investigate. What we found was chilling, so keep reading to find out the truth about this fraudulent provider for yourself.

| Up to 1:500 | |

| Unregulated Scam Broker | |

| 15 St Botolph St, London

EC3A 7BB, UK |

|

| 100 GBP | |

| 1/5 | |

| Forex, Indices, Stocks, Commodities | |

| Web | |

| 0.7 pips |

Is GCB London Broker a Scam or Legit?

Our FX Jack the Ripper must be stopped. Claiming to have an official UK address is scandalous! After a closer look at GCB London LTD, multiple red flags popped up.

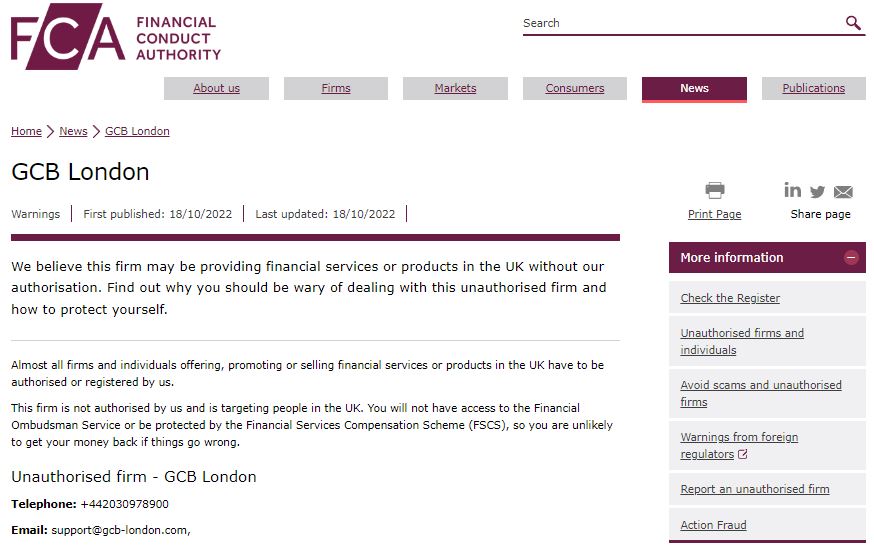

Naturally, the first step was to search for this broker in the database of the UK’s Financial Conduct Authority (FCA). We expected to see it in good light, but the result was shocking, to say the least. Turns out, the FCA had issued a firm warning against this fraudulent entity.

This revelation was followed by several other warnings against GCB London by European regulators such as CONSOB, KNF, and AMF.

WARNINGS:

What Options Do Traders Have for Online Platforms?

Given the illicit status of GCB London, we didn’t expect much in terms of a reliable trading platform. And we were right. The only available platform is the browser-based WebTrader.

If you ask us, this is a poor choice and an ineffective trading solution. The platform simply lacks advanced tools that have facilitated trading over the years such as automated trading customization, API integration, live reports, branch optimization, etc.

For all these features and more, you ought to find a credible and licensed provider that offers top-notch trading platforms such as Meta Trader 4 or Meta Trader 5.

We wouldn’t trust an unregulated broker offering WebTrader at all because there’s a great chance that the platform is rigged. Yup, every number, chart, and parameter you see on it is fake; the trading profits are fabricated. The only thing that’s real is the deposit button. As you may have guessed, the money isn’t meant for trading but for the scammer to embezzle.

GCB London Accounts Types

According to GCB London’s website, the shady provider offers five different account types:

- Beginner – 100 EUR;

- Silver – 2,500 EUR;

- Investor – 20,000 EUR;

- Premium – 100,000 EUR;

- Gold – 200,000 EUR.

Each subsequent type offers a wider range of assets and an option to choose from floating and fixed spreads. Small discrepancy – GCB London mentions on the home page that the minimum deposit is 100 GBP but here we see euros. It’s the small details that gave the scammer away.

Furthermore, the leverage cap is 1:500, which is considerably higher than the legal limit imposed in GCB London’s alleged homeland. The FCA was clear when it set the leverage cap at 1:30 for retail clients to prevent great losses. As for spreads, they start from 0.7 pips. That’s actually good but irrelevant considering all the shadiness surrounding this broker.

Trading Instruments at GCB London

Let’s make an overview of the available trading assets at GCB London with a few examples:

- Forex currency pairs – EUR/USD, GBP/AUD, USD/JPY…

- Commodities – gold, silver, brent oil…

- Indices – DJIA, GERMANY 30, NIKKEI 225, US 100…

- Shares – Apple, Samsung, Visa…

Quite nice, we must say. However, we wouldn’t recommend you buy into this hoax. First of all, these instruments are useless if you cannot actually trade them. Remember what we said about the rigged platform? That’s why it’s better to trust a regulated broker with your hard-earned money.

GCB London Deposit and Withdrawal

On the website, we found four different payment methods that GCB London claims to accept:

- Credit/debit cards (MasterCard/Visa);

- Wire transfers;

- Cryptocurrencies;

- QIWI.

Allegedly, all the transactions are free of fee. The minimum deposit is 100 GBP. However, for crypto, it’s 250 GBP. As for withdrawal processing, credit/debit cards & crypto require up to 24 hours while wire transfers take 3-5 banking days. But, we honestly believe that there will not be any withdrawals.

How Do I Recover My Money If Scammed Me?

It’s terrible that you’ve been scammed and we understand your frustration. However, your experience can help save countless others from this foul scheme. For our part, we can help you get your money back. Read about the following refund methods.

- A chargeback is the reversal of credit/debit card transactions. It can be requested at the issuing bank within 540 days.

- Wire transfers can be reversed via recall but only if the transaction hasn’t gone through yet.

- Crypto payments can be traced to a wallet within a crypto exchange. If successful, you can request a refund from the exchange.

- If you’ve deposited funds via QIWI, you will have to contact the company’s support team and find out whether a refund is possible.

GCB London Summary

- GCB London is an unregulated shady broker that plans to defraud unsuspecting victims;

- The broker has been blacklisted by the FCA, CONSOB, KNF, and AMF;

- Only WebTrader is available as the trading platform;

- Leverage is overwhelming and significantly exceeds the legal limit.

FAQs About GCB London Broker

What Is The Minimum Deposit For GCB London?

The minimum deposit that GCB London requires is 100 GBP/EUR.

How Long Do GCB London Withdrawals Take?

GCB London claims that withdrawals take up to 24 hours for credit/debit cards & crypto and 3-5 banking days for wire transfers.

Is GCB London a Trustworthy Broker?

GCB London is far from a trustworthy broker. It has been blacklisted by four reputable regulatory authorities.