Table of Content

GStockLegal Review – Lies Behind GStockLegal.Com Broker

Table of Content

GStockLegal is a newly registered brokerage company with no precise background info except a fictional address in the UK. Nonetheless, the firm claims to be a successful, licensed provider of online financial services.

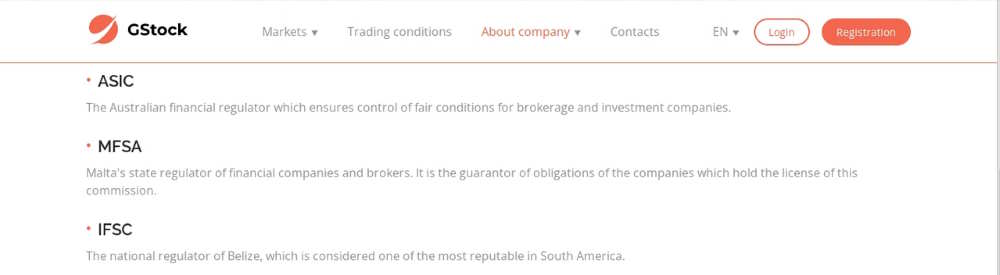

The broker was supposedly authorized by IFSC, MFSA and ASIC. Attop of that, GStockLegal advertises as a JP Morgan affiliate and MiFID standards follower.

A variety of services offered through distinctive account types with more than 200 trading instruments available, this broker shows no shame when it comes to misleading information.

| https://gstocklegal.com/ | |

| [email protected] | |

| +442080896557 | |

| From 1:100 to 1:500 | |

| Not regulated | |

| London | |

| $250 | |

| Not available | |

| 1/5 | |

| Fx | |

| Web based | |

| N/A |

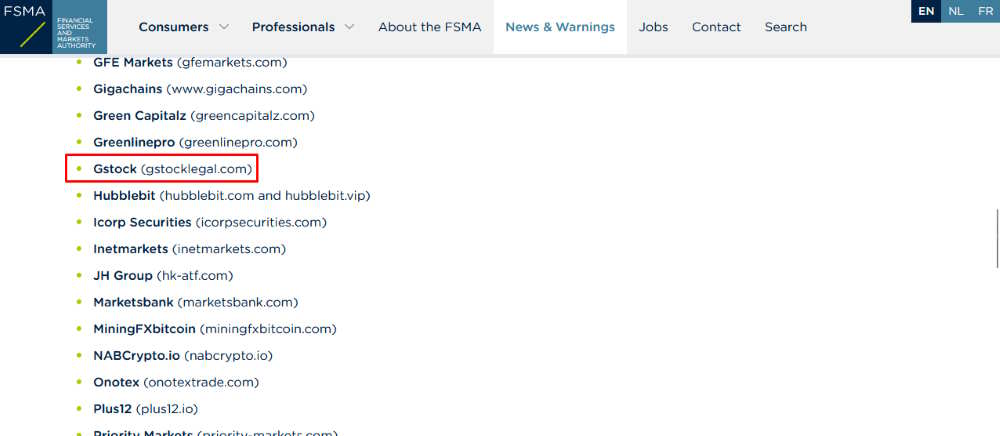

Factual state is that this broker is not regulated and potentially dangerous to investors’ funds. Belgian regulator FSMA has blacklisted them: https://www.fsma.be/en/warnings/fsma-identifies-new-fraudulent-online-trading-platforms-2

GStockLegal – Compliance and Safety

Since GStockLegal asures the clients to be regulated by several financial authorities, we’ve set out to inspect that. Claims about being licensed by MFSA, IFSC and ASIC turn out to be blatant lies.

When encountering a suspicious broker that hides their basic company details, be sure to check the registers of regulators they list. GStockLegal names a few financial authorities but after checking their databases of regulated brokers, GStockLegal seems not to be among them.

Offshore regulators like IFSC don’t enforce strict regulatory standards like a top tier regulator, in this case ASIC. Being regulated by ASIC would mean GStockLegal had minimum capital invested for long term operating, client funds segregation, leverage restriction, negative balance protection and a set compensation scheme. Unfortunately, not appearing in their database of regulated brokers, denies this fact and makes GStockLegal a deceiver and a fraud.

Legal brokerage companies comply with MiFID rules, applied in order to ensure the transparency of transactions and prevent money laundering.

The User Agreement even mentions the jurisdictional court to be the court of the Republic of Vanuatu, which could actually be the real location of the company.

GStockLegal provides no legal documentation to back any of their claims about being licensed, so it’s obvious they cannot be trusted. This broker cannot guarantee the safety of their clients’ funds like legitimate brokers. Neither can they confirm the enforcement of customer protection, so think twice before investing here.

Overview of the GStockLegal Trading Platform

Accessing the trading platform revals an overly simplistic web trader that only vaguely resembles reliable trading software. This form of a trading terminal is a basic imitation of legitimate software and it appears similar to what many scammers use.

Its primary function is maintaining an illusion of trading going on, while nothing is actually happening. Novice traders are deceived and kept in belief they’re accumulating funds, while their investment goes straight to the fraudster.

Account Types Offered at GStockLegal

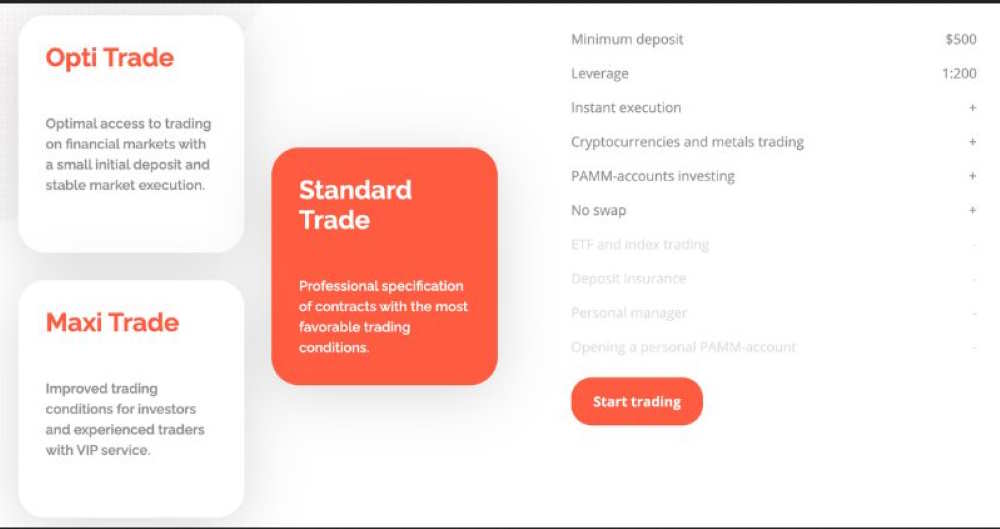

Three types of accounts can be opened at GStockLegal:

- Opti Trade

- Standard Trade

- Maxi Trade

Minimum amount required in order to open an account is $250. Leverage offered is from 1:100 to 1:500. Obviously a scammer strategy, as legal brokers have to respect the leverage restriction of about 1:30.

The more expensive the account, supposedly better trading conditions are given. Some of them are deposit insurance, personal manager, no swap and access to a wider range of instruments.

GStockLegal Trading Instruments

Despite being an unscrupulous broker, GStockLegal puts additional effort into convincing customers they can trade numerous instruments. All of them are grouped into several major categories:

- Currencies (currency pairs like AUD/CAD, USD/HUF, AUD/CHF, EUR/AUD, CHF/JPY)

- Metals (Instruments table only shows gold as the available instrument)

- Stocks (L’Oreal, MICEX, NVIDIA Corp, Apple Inc, Admiral Group, etc)

- Commodities (Brent Crude Oil, Natural Gas, Corn, Orange, WTI Crude Oil)

- Indices (CAC40, Nasdaq 100, DAX30, Dow Jones, FTSE100, Nikkei 225)

- Cryptocurrencies (BCH/USD, BTC/EUR, DSH/USD, BTC/USD, ETH/USD)

Deposits and Withdrawals Process

As expected of a confirmed scammer, the only payment method accepted from the trading area is crypto. Generally the most preferred funding method by bogus brokers is crypto depositing. The goal is to make it as hard as possible for the client to get a refund while the fraud keeps their virtual anonymity.

Acclaimed brokers offer funding methods like credit/debit cards, bank wire transfer and trusted E-wallets.

Minimum deposit amount is $250, while withdrawal can first be inquired after at least 20 trading days. Not much about the withdrawal procedure is mentioned on the site or in the User Agreement.

GStockLegal Defrauded Me – How Can I Receive a Refund?

If you have been defrauded by GStockLegal, it’s of crucial importance to act fast. Consulting government agencies in charge of dealing with cyber crime is highly recommended.

Financial authorities can take legal action needed against the scamming scheme.

Another step towards getting your funds back is contacting your bank, changing credit/debit cards info and requesting a chargeback.

Please refrain from getting in touch with any kind of recovery agents. These boiler room operators are sophisticated scammers who aim to further defraud you.

GStockLegal Summary

- Not regulated

- No company info provided

- High leverage

- No reliable trading platform

- Lack of withdrawal info

FAQs About GStockLegal Broker

Is My Money Safe at GStockLegal Broker?

Illegal brokers cannot provide safety of clients’ funds, so it's the same with GStockLegal.

How Long Do GStockLegal Withdrawals Take?

Withdrawal requests can be sent at least 20 days after depositing but it’s not clear how long the withdrawal processing lasts.

What Are The Funding Methods For GStockLegal?

Only accepted way of depositing funds with GStockLegal is crypto.