Table of Content

LibraPros Review: Read Before You Trade With This Broker

Table of Content

Welcome to the LibraPros Review. Here, we’ll weigh in on a controversial scam broker by the name of LibraPros. The first thing that strikes you when you look at this fraudster is the incredible vagueness surrounding it. Key facts and information were left out. Thus, we’ll provide you with general guidelines for avoiding this investment scam and similar schemes.

The broker’s website is completely anonymous and the provider itself is shrouded in mystery. Thus, analyzing what clients are offered was a bit harder but at least there was no ambiguity when it came to fraudulent status.

| N/A | |

| Unregulated | |

| SVG | |

| N/A | |

| 1/5 | |

| N/A | |

| N/A |

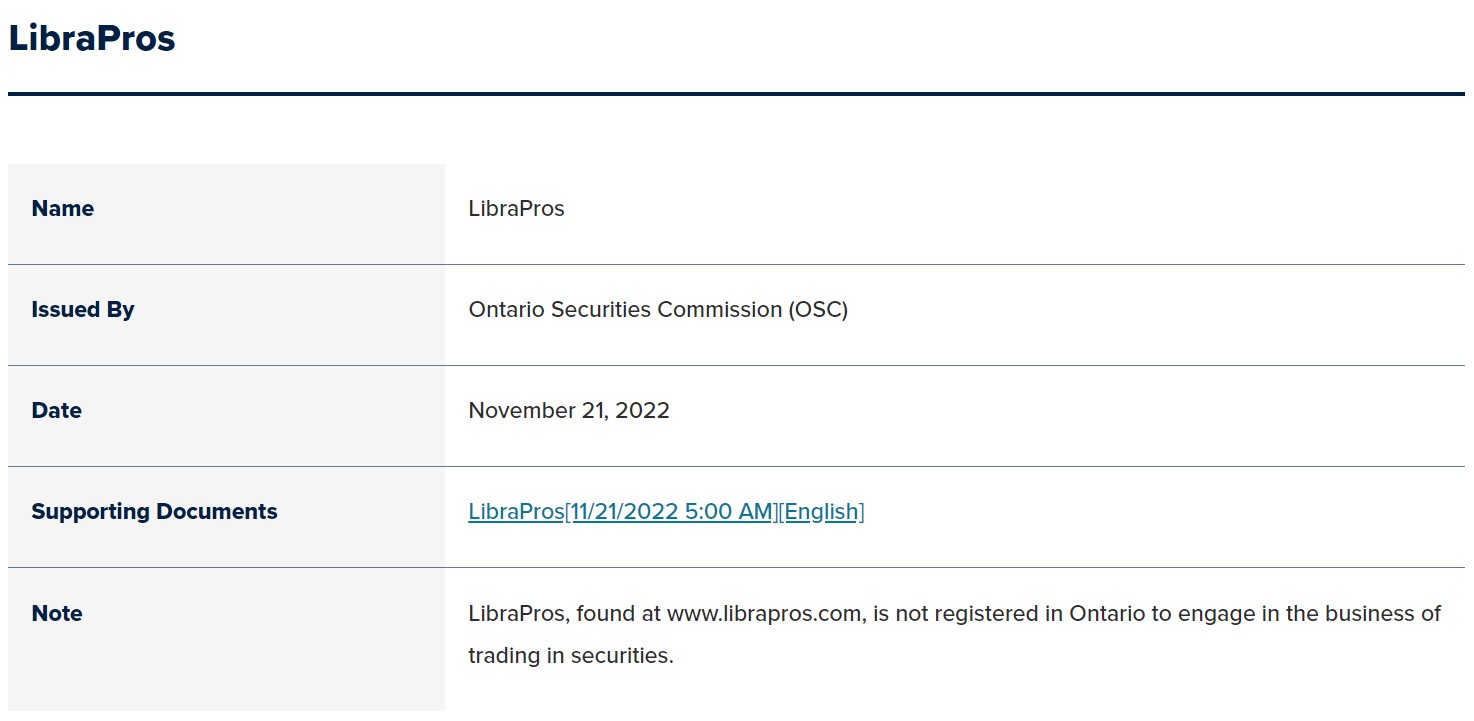

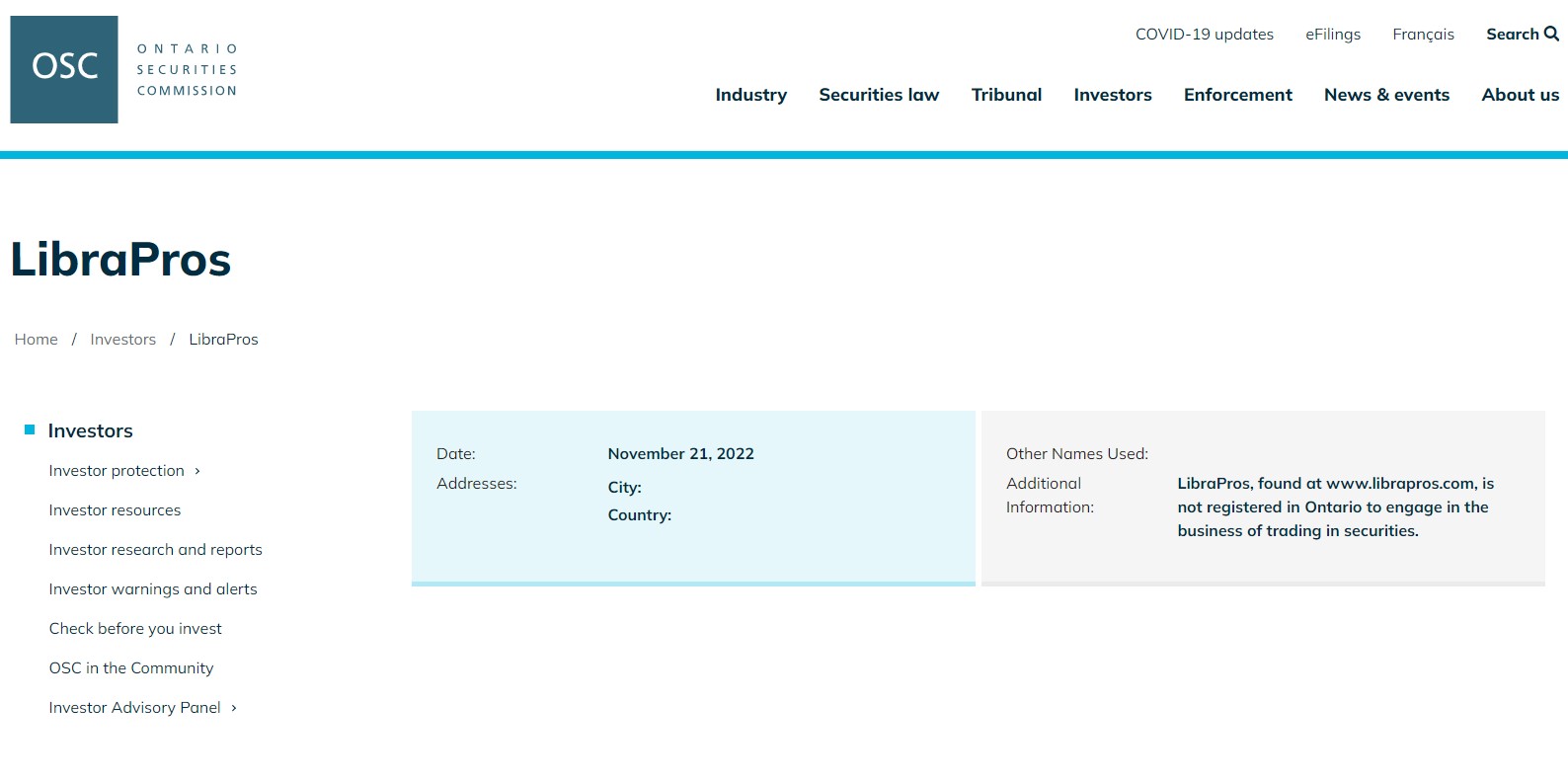

Warnings:

Regulation of LibraPros and Funds Security

Let’s get into it, shall we? It’s impossible not to address the broker’s status first, i. e. whether it has a license or not. Right away, we noticed a contradiction that made us raise our eyebrows. In the legal documentation, the financial swindler first claimed it operated under the jurisdiction of St. Vincent and the Grenadines (SVG).

However, it’s common knowledge that SVG’s Financial Services Authority (FSA) explicitly stated it did not license Forex brokerage activities. For this reason, SVG has become the hub of numerous malicious scams.

Next up, we’ve got the clause that says LibraPros abides by Bulgarian law. Hm, what’s Bulgaria got to do with SVG? More importantly, if the broker respects Bulgarian law, then it must also respect European regulations since Bulgaria is an EU member state. We can tell you straight away that it’s not the case simply by pointing out the anonymous website.

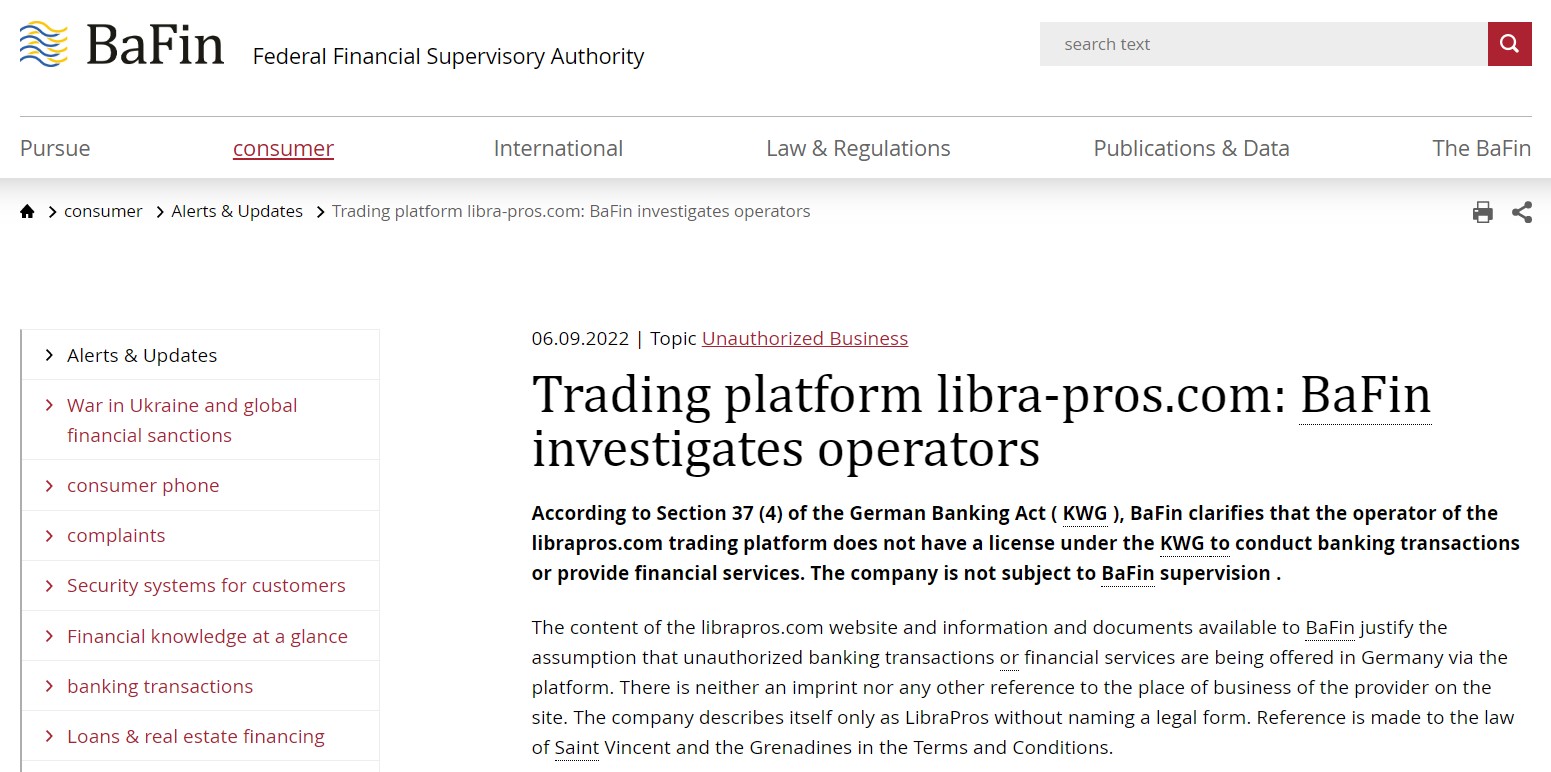

All things considered, we’ve got ourselves an outrageous and risky offshore provider that violated every possible item of the financial market etiquette. Need more proof? Check out the warnings issued against the scammer we provided. Aside from the Canadian regulators, LibraPros managed to disrupt the balance by pissing off the big dog, the German BaFin!

LibraPros Trading Software Overview

It seems that LibraPros did not bother going step by step to appear legit. The unscrupulous broker does not allow you to view the trading platform, which is supposedly web-based, until you make the initial deposit. Our spidey sense is tingling, there is something awfully fishy about this condition.

Nevertheless, the scammer did include download links for two apps – AnyDesk and TeamViewer. While these apps aren’t necessarily risky, they can easily be abused to the nature of their purpose, which is to allow person X to access the desktop of person Y. Imagine the damage LibraPros could cause if it had access to your files.

What Account Types Does LibraPros Offer?

We know absolutely nothing about the account types that LibraPros offer. We’re unsure if there are any at all. That’s the problem. The lack of transparency is really worrying and problematic. Be sure that such issues do not occur with the broker you trust.

What Can Be Traded on LibraPros Market?

Once again, we were unable to check this because the scammer’s website was taken down. Regardless, we are pretty sure that we know the answer – nothing. Ignore whatever these tricksters promise on their websites since most of them never provide a single thing.

Especially this one, it denies you access to the trading platform unless you invest. Legitimate brokers would always allow you to get a glimpse of what you’re getting. Also, trustworthy providers are quite transparent, unlike this shady fraudster.

Deposit and Withdrawal Process

This is where things get really outrageous. The shameless broker blatantly failed to specify the minimal amount it requires clients to pay. Hence, we conclude that it carefully selects its victims and then privately gives them the necessary information for the wrongdoing to work.

However, we did find this info related to fees. Check this out – LibraPros charges an advance commission of 20% of the deposit. Despicable! If that was not enough, it also charges fees of $25 for credit card & e-wallet payments and $50 for wire transfers.

Whichever amount this phony demands, we assure you that you can find a reliable and licensed broker that would charge you the same amount, if not lower.

How Do I Receive A Refund If I Was Scammed by Librapros?

Don’t feel ashamed if you’ve been scammed. It could’ve happened to anybody. We try to provide a remedy for your bane by telling you a thing or two about the methods for reversing card transactions and wire transfers.

Enter a chargeback. You can request it at the issuing bank within 540 days but it will only work if you haven’t given copies of your personal documents to the scammer.

For wire transfers, you ought to request a recall. The transaction must not have gone through for the recall to work. Thus, it is extremely important that you act with haste!

LibraPros Summary

- LibraPros is a shady and fraudulent broker based in SVG;

- The broker, as well as its website, is completely anonymous;

- Blacklisted by regulators of Canada and Germany;

- Trading conditions, platforms and the minimum deposit are all unknown;

- There are contradictions in the legal section.

FAQs About LibraPros Broker

Is LibraPros A Reputable Broker?

LibraPros is far from a reputable broker. What’s more, it has been blacklisted.

What are LibraPros's Funding Options?

LibraPros mentioned credit card transactions, wire transfers and e-payments in the fee section.

Does LibraPros Provide Trial Accounts?

LibraPros does not provide any type of account. The fraudster is only interested in the initial deposit.