Table of Content

Prism Capital Review – Sign That PrismCapital.Pro Is A Scam

Table of Content

Prism Capital says to be owned by a company named Sanguine Solutions LLC, located in Saint Vincent and the Grenadines. SVG seems to be popular as a fraud haven, some sort of safe place for scammer schemes to operate safely from.

| Leverage | 1:100 |

| Regulation | Unregulated |

| Headquarters | SVG |

| Minimum Deposit | $250 |

| Review Rating | 1/5 |

| Broker Type | Forex |

| Platforms | Mobile |

| Spread | 3 |

The reason for this is because this island doesn’t have a regulatory body authorized to oversee the activity of firms that offer financial services. It wouldn’t happen to be the first or the last time a suspicious offshore company emerges from SVG, while claiming to be fully regulated for the online trading services it offers.

Regulation of Prism Capital and Fund Security

Being unregulated for a broker means that they don’t comply with the rules set by jurisdictional regulators. Financial authorities set high standards for brokerage companies in order to certify the security of clients’ funds.

Not only that, but the conditions are there to be met so the brokerage company is sure to run a stable, sustainable business, with enough beginning capital and capable leadership. Regulatory standards further define the explicit rules of conducting a business in the sphere of online trading.

Offshore brokers operate unlicensed with the prime goal of defrauding clients. Keeping their virtual anonymity, they intend to abuse their clients’ investments.

Overview of the Prism Capital Trading Platform

Prism Capital offers only a mobile based trading platform that is supposedly fast and easy to use. From the looks of it, it seems plain simple with some basic features. Generally, it comes off as quite unprofessional from a brokerage firm to offer only a mobile app.

Major brokerage companies offer users reliable trading software, accessible across different platforms. Such are MT4 and MT5, trading platforms that are well ahead of the competition with their various features, lighting-fast executions, customizations available and other built-in options.

Available Account Types at Prism Capital

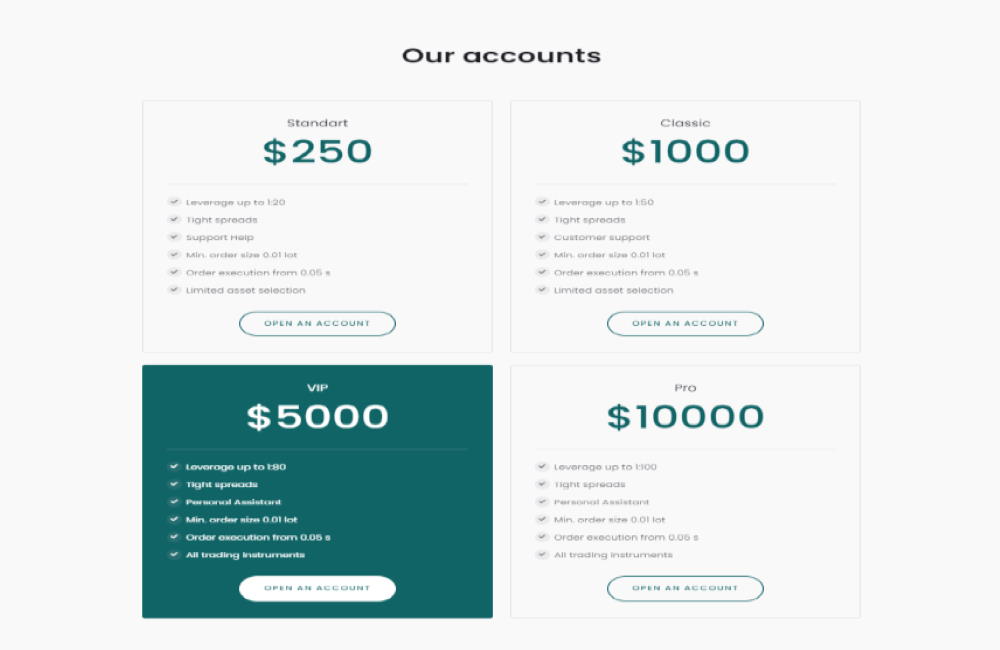

Clients interested in investing with Prism Capital have to deposit a minimum amount of $250 in order to make a Standard account and start trading. All account types available at Prism Capital are:

- Standard

- Classic

- VIP

- Pro

For any other account than Standard, required deposit is much higher, but so are the benefits. Or so Prism Capital claims. The more money users deposit, the richer the features, higher the leverage, tighter the spread and wider the range of trading instruments available. Needless to mention that actually acclaimed brokers do not require ridiculously high deposits like Prism Capital does for Pro account for example ($10 000).

Trading Instruments Overview

Forex, indices, futures, obligations and currencies seem to be the major groups of assets available for trading at Prism Capital. Each group of assets includes several trading instruments but it still looks like an insufficient and inadequate range. Especially if it was to be compared to thousands of trading instruments that successful brokerage companies offer. Most successful brokers allow the users advantage of trading on most popular markets in the world. Regulated brokers have access to hundreds or thousands of trading instruments. The choice with Prism Capital is quite narrow in comparison.

Prism Capital Deposit and Withdrawal Process

Although we are assured by the site that several depositing methods are accepted, in truth, users are only allowed to fund their account by depositing in crypto. Common method preferred by phony brokers to make it harder for the investors to withdraw their funds.

Prism Capital renounces any responsibility in case clients are charged any fees upon withdrawals, deeming the bank solely responsible for the fees imposed.

While the broker does offer bonuses, they come at a certain price. It is stated that in order to make a withdrawal the client has to meet a trading volume required. That trading volume is set to an amount equal to (deposit+bonus)x25. Also, when submitting a withdrawal request, the client will be asked to provide a ton of additional documentation.

Prism Capital Scammed Me – How Can I Get a Refund?

The best would be not to trade at all at Prism Capital, than to have your funds stolen by a scammer. Just choose an acclaimed broker that you know for sure is transparent and fully regulated.

Government authorities should be contacted in order to attempt to restore the stolen funds. Furthermore, it’s crucial to change credit card information so it wouldn’t be abused. Trusting recovery agents who charge you a high price for their services is another risk of losing more money, energy and time.

Invest smart, don’t trust unlicensed brokers and always perform a double check when in doubt about a firm offering financial services. Sharing experiences online with other scam victims may help when seeking advice and will perhaps prevent scammers from defrauding another unsuspecting victim.

Prism Capital Summary

- No license or regulation

- Offshore company

- No reliable trading software

- Fees and trading volume required for withdrawals

FAQs About Prism Capital Broker

Is Prism Capital Regulated?

No, Prism Capital is not regulated and doesn’t have a license to conduct the business of online trading.

Is Prism Capital a Trustworthy Broker?

No, since Prism Capital is not regulated and licensed, they are not a reliable broker and can’t ensure the safety of funds.

What Funding Methods Does Prism Capital Accept?

Website claims to accept credit/debit cards and wire transfer but only depositing in crypto is actually allowed.